Do you review your salon’s profit & loss report on a monthly basis? Do you know what your salon’s bottom line was last month? Do you understand the what, why, and how of the numbers you use to make decisions? You should! The P&L Report is one of the most important tools when it comes to managing your business and increasing your bottom line. When you understand the basics, you can start planning fun things like salon facelifts, expansions, bringing in a new product line, or education for the whole team.

Are You In The Dark?

When it comes to their salon’s finances, most salon owners are in the dark. Without pointing fingers at anyone, I once started working with a salon who genuinely didn’t know that they were spending close to $5,000 on printed Holiday Cards. It was only when I began reviewing the profit & loss report with the owner that it became clear that a previous manager must’ve been overwhelmed and completed requests as quickly as possible without researching costs. This would often result in paying rush fees and other unnecessary expenses to meet arbitrary deadlines. If the P&L Report had been thoroughly reviewed every month, the owner would have quickly discovered these unjustifiable spendings

The Profit & Loss Report Tells A Story

The P&L report tells you how much money you both made and spent during a specific period. To get the most out of your Profit & Loss Report, use salon specific categories for your income & expense accounts. This will allow you to determine if the percentage of income per item is in line with industry standards and whether your salon is operating at a profit or a loss. From here, you can formulate a plan to increase your bottom line by cutting costs and finding areas for growth.

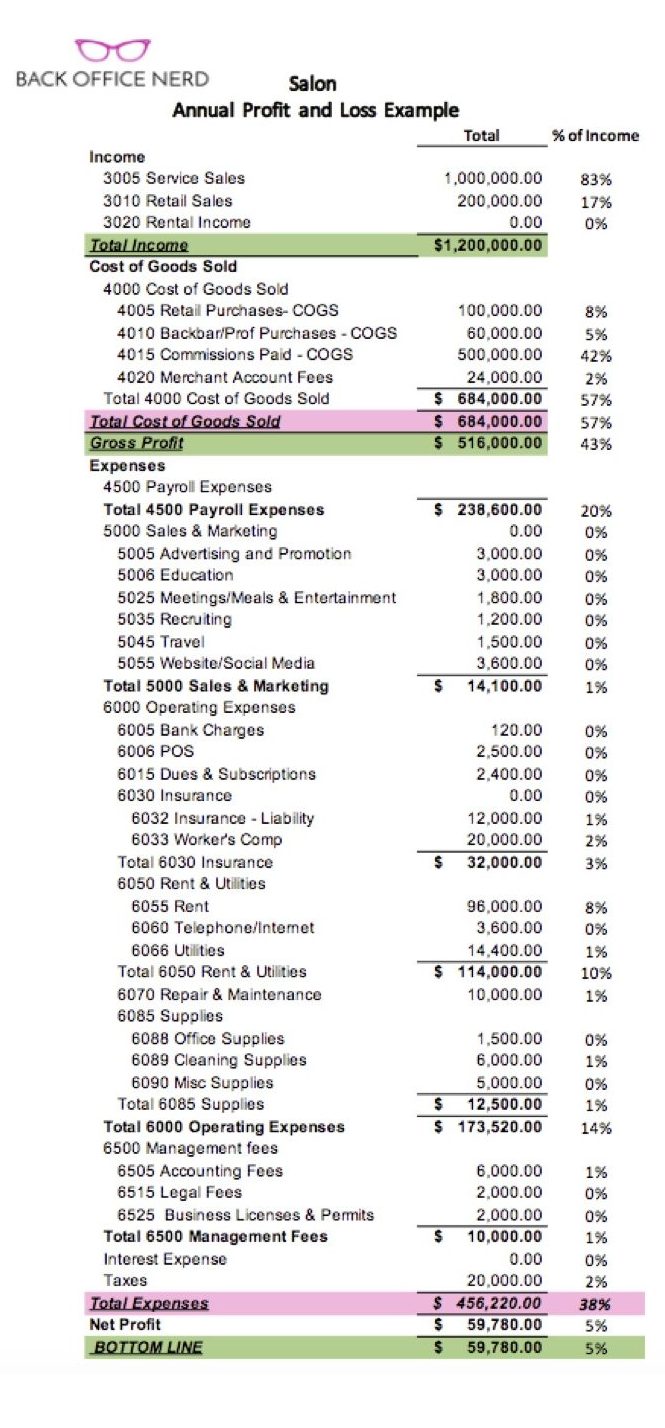

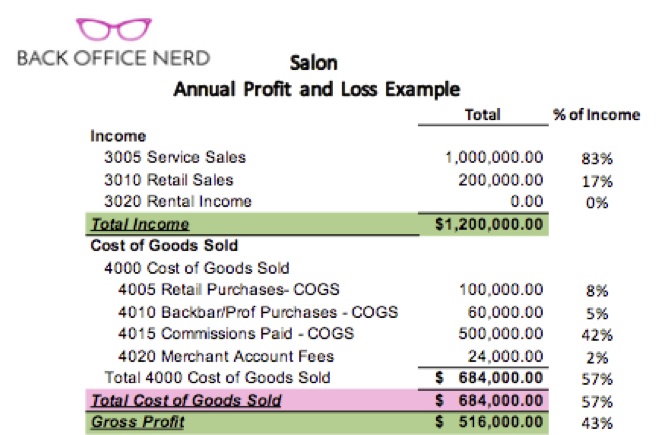

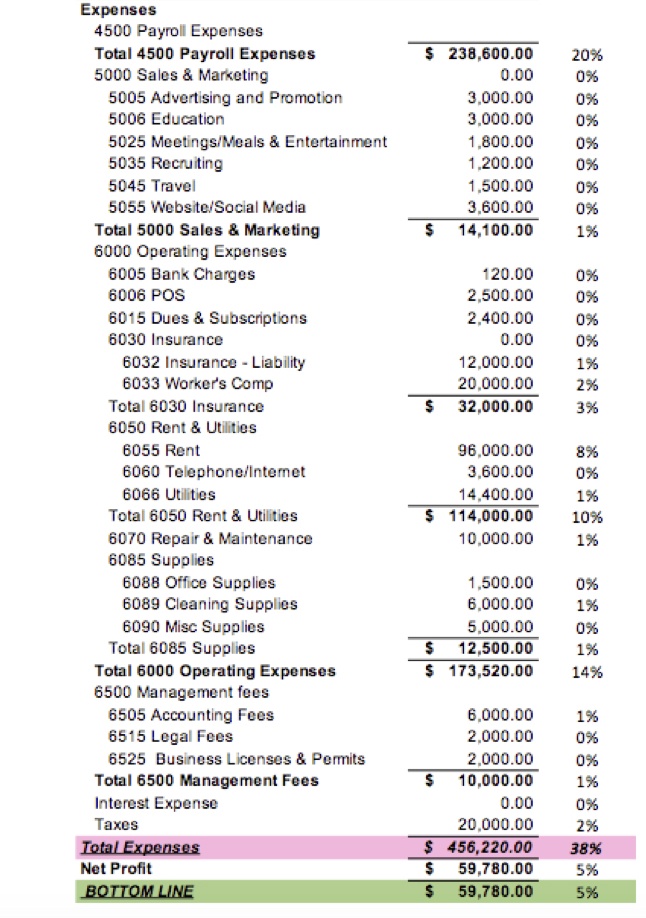

Here is an example of a salon specific P&L Report:

How To Read A P&L Report

To understand how to read a Profit and Loss Report, think of it as a ladder. At the top, you see the total amount of service/retail sales and rental income made during a specific period.

Then, you step down to Cost of Goods Sold. Each line is a deduction from the income for retail purchases, back bar purchases, commissions paid, and merchant fees. This will give you your Gross Profit which is the total money left after the Cost of Goods are subtracted.

The next step down is Expenses. Each line is subtracted from the income for things like payroll, marketing, operating expenses, and management fees until you reach the bottom step, Bottom Line, also known as the Net Profit. This is the amount after all the expenses are deducted which shows if the salon earned or lost during a specific period.

Next Steps

Now that you have the basics, compare the current month to the previous month. Look at your Cost of Goods Sold. COGS will fluctuate from month to month. This figure is based on your sales.

Example | You sold for $5000 and purchased for $2500 in retail inventory in the current month. Your retail inventory purchased was 50% of the retail sales. In the previous month, you should see that your inventory purchases were a similar percentage of your retail sales. If you sold $3000, and you purchased $1500 in inventory, the percentage of your purchases are still 50% of the retail sales.

If you find that the percentages are not similar, investigate. Here are a few places to start:

- Did you place a retail order towards the end of the month? If so, you won’t see the return on that purchase until the following month.

- Maybe the wholesale cost was entered wrong?

- Or did you actually over-order? If you over-ordered, reach out to your vendor, who should be happy to swap out items for your top sellers. After all, they want you to move your products too! Or, run a Promo for the month to push your slow-moving products.

This is where inventory reports from an intuitive software like Phorest is invaluable! You can run one and know what products are moving and what products need some promo love in just seconds.

Still With Me?

When comparing Service Commission COGS, keep in mind that the more you do in Service Sales, the higher your Cost of Goods will be for Service Commission. The percentage of Service Commission to Service Sales should be similar when comparing month-to-month. That is, even if the dollar amount is significantly different. Continue comparing each Cost of Goods Account to the previous month.

Understanding & Reviewing Expenses

The next thing to look at on your profit & loss report is your Expenses. Most of these are fixed, which means they should be relatively the same each month. Start with your Payroll Expenses. Again, compare it to the month prior. If the amount isn’t similar, investigate.

- How many pay periods fell in that month?

- Did you have a month with 5 pay periods vs 4 periods in the previous month?

- Was someone paid overtime?

- Did someone forget to clock out and the hours were inflated by not catching it?

- Was there a commission error (see if the commission was entered for a receptionist when it was meant for a stylist)?

The commission may have been entered twice if it was in the wrong column and went unnoticed. Continue to go through the P&L Report line by line until you reach the bottom.

This may seem overwhelming at first, but once you review these on a monthly basis, you’ll truly understand your salon’s financials, and you’ll start to see opportunities for growth, where you can cut costs, and increase your bottom line.

Looking for personalised advice? To schedule a free Business Health Consultation with Danielle, visit backofficenerd.com or contact danielle@backofficenerd.com! Got general feedback? Let us know in the comments below or on Instagram!

For more great tips, check out our full resource on how to set up, run and grow a successful salon business.

Looking for a salon software that makes accounting easier?